Okay.. so? the amount of money is not finite.. and thus whether you spend that money or "let it sit" it does not affect anyone elses spending.

Jaeger, your whole "infinite amount of money" angle is just dumb. There is a big difference between already having money to spend and being able to borrow in order to spend.

Lets see yes.. So? Serously.. so what? You act like that's a bad thing. As far as takes "creating new loans? Sure.. so?

So, more private sector debt. More consumer debt. Your savings requires some other party to be in debt.

and no it does not require new deficit spending. that's where taxes come into play.

Taxes also reduce one's ability to spend. You really haven't thought this through, have you?

You seem to think production is the be all end all..

Without production, what kind of economy would we have?

Except that profitability does have an influence on a banks ability to make a loan.

No, it doesn't. It has an influence on the amount of money a bank makes from a loan, that's it. This line of argument is a direct consequence of you stepping in it when you claimed that banks loaned out deposits. Then when I called you on that, you switched course (without admitting that you were wrong, of course) and said that you were talking about cheaper reserves

all along (total b.s.). But you still missed on the fact that

more profitable =/=

more possible.

That's funny... really FUNNY.. you "taught me"..

Okay sir.. whatever you need to help your ego.

You can go back and check our old threads if you like. The fact is that you are far more correct now than you were then - which is a good thing. And you have somehow adopted a lot of my arguments since then. But I think Ganesh made an astute observation when he wrote that you are desperately afraid of being wrong. You would rather win a debate than be correct. And when you hang onto bad arguments, then morph your views along the way, all while claiming that was what you meant all along, that's just intellectual dishonesty.

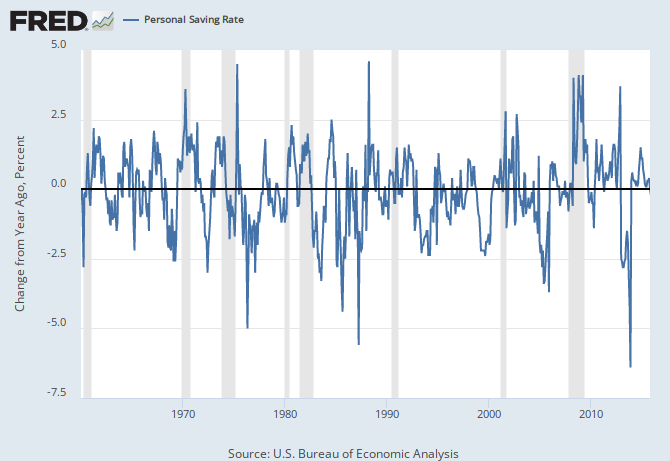

Nope.. because net savings does not subtract from aggregate demand. Not in a system with essentially limitless money.

This is a losing argument, Jaeger, and sooner or later you are going to have to abandon it. Production = Income is a very basic tenet.

Actually no.. the very real consequences. Which history has taught us has happened to economies.

Then give us a few examples of hyperinflation that wasn't preceded by a drop in production.

I do.. unfortunately you don't. right now.. in our present situation... balanced budget good. some deficit spending okay.. current level of deficit spending BAD.

If our current level of deficit spending is BAD, then you should have no problem pointing to some economic problems attributable to that deficit spending.

Well I understand that you don't like the faith argument but when it comes to money.. it is all about faith. Money has no intrinsic value so the only value it has is the faith that you and the person that will accept it has in it.

...call it what you will, value is based on production and what you can buy with your money. Just like when people don't understand the science behind natural phenomena, they attribute those things to God. You don't understand why money works, so you attribute it to "faith."