Now, these macroeconomic ding dongs think employment is improving. No...it is not...unless some very high end and TONS of very low end jobs (with little in the middle) is their idea of 'improving'.

Yer usual load of vague nonsense. Let's see some data to back that up.

>>Once again, look at the by far most important age group for America...the 25-54's. In the last year, the employment to population ratio (which takes demographics into account) has dropped from 76.7% to 76.5%

It's impossible to tell which lie yer expounding in this particular case. The overall civilian employment-population ratio has

INCREASED over the past twelve months from 59% to 59.3%. It was

never that high until Jun 1978. If you look at just the 25-54 cohort, it has

INCREASED from 76.6% to 77.1%. It was

never that high until Nov 1985.

>>So, if the U-3 is dropping but so is the employment to population ratio of the most important age range … then that means that …

And so if "the employment to population ratio of the most important age range" is

NOT dropping, then I guess yer analysis is entirely worthless.

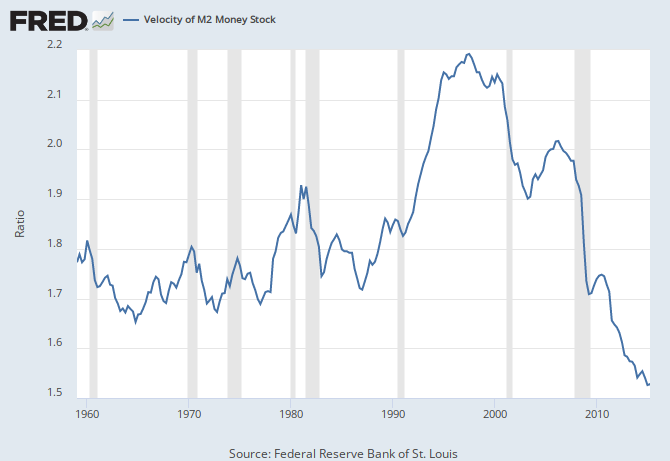

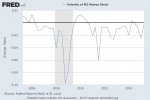

>>Plus, the M2 money velocity continues to plummet. … as the chart shows, the M2 money velocity ratio is the lowest in over 55 years and continues to drop...hard.

Let's look at a narrower range of that measure, one that charts the year-to-year percentage change.

Only once since Q1 2009 did it drop by more than .027 (Q3 2011). Since Q3 2009, the ratio has fallen by .216, from 1.71 to 1.494. That's a 12.6% drop over six years. It's been virtually flat in the last fifteen months, dropping by only .035, with most of that (.025) occurring in one quarter (Q4 2014).

"Continuing to plummet?" Continuing to drop hard"? Two percent a year? A total of

.01 — six-tenths of one percent — in four of the past five quarters?

>>If the velocity is this bad - and getting worse every 1/4 - what the heck is going to happen …

First, what is "bad" about the velocity? You never explain that. Secondly, it is

NOT "getting worse every 1/4." It went

UP Q2 2014, and it was still higher in Q3 than it was in Q1.

>>So, the 25-54's are getting less and less employed per capita

That's a lie.

>>the Money velocity is in near free fall still

That too is a lie.

>>Throw in the fact that the inflation rate stubbornly refuses to budge anywhere near the Fed's 2% goal

So if inflation were higher, that would good for the economy?

>>these facts point to the obvious..the economy is stagnating.

Real GDP will continue to grow at 2-3% over the next eighteen months.