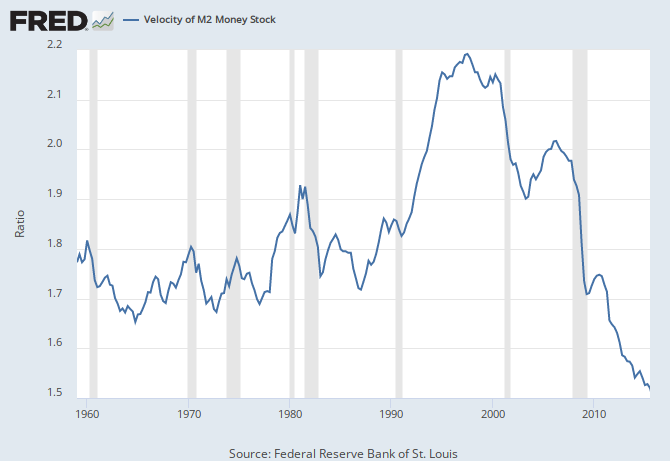

The Fed is keenly aware that the money multiplier has fallen to abnormally low levels. Reasons are complex and not fully understood. That low multiplier is part of the reason the Fed correctly understood that QE would not create a hyperinflationary outbreak and/or collapse of the dollar as envisioned by Peter Schiff, among some others.

The Fed are usually the LAST to know. Remember the 2007 crash?

Federal Reserve was blind to crisis brewing in early 2007 - Jan. 18, 2013

They COMPLETELY missed a huge correction even though it was RIDICULOUSLY obvious that it was coming.

The Fed said from the very beginning that each QE would be the last...they were wrong every time.

And the reasons for the M2 falling is, with respect, not complex to me in the slightest...despite the government figures, people are NOT spending - they are just creating debt (in essence). Money is not changing hands that often. All people are doing is taking out huge amounts of debt with incredibly low interest rates.

When you create debt to buy a toaster (putting it on a credit card/line of credit), the money velocity is minimal as the money is 'created' at the point of purchase and that is where it stops (for now). But when you buy a toaster with money you earned, then you took money that you made and then spent it on a toaster. 'New' money is not created, just existing money and it is used again. That causes the money velocity to rise. Add in the fact that the banks are making solid returns on a virtual 'carry trade' with the Fed/others - they have no reason to lend out money at greater risk. Add in the fact that the home ownership rate is falling fast, even less money being circulated.

Look at employment since November 2007 (the month before the Great Recession began):

http://www.bls.gov/news.release/archives/empsit_03072008.pdf Table A-6

http://www.bls.gov/news.release/pdf/empsit.pdf Table A-9

By far the most important demographic is the 25-54 age range. They have by far the most dependants and buy by far the most big ticket items. They also make up roughly 60% of the workforce. They are the key to a healthy economy.

I already showed above how the employment to population ratio of that group has never remotely recovered since the Great Recession. But let's look at some raw numbers.

There are over 3 1/2 MILLION less 25-54's employed since then. In fact, in EVERY major age grouping, there are less people employed now then before the Great Recession (25-54, 16-19 and 20-24). ALL of those jobs (in essence) have gone to one group - the over 55's. Over 7 million newly employed 55+'s; and as the employment to population ratio proves, the cause is by no means just an ageing population. The middle class is stagnating and and youth are finding less work. And the elderly are having to delay retirement because the nest egg they thought they had is not enough to pay the bills now - largely thanks to the record low interests rates which so many seniors were counting on for a return on their savings.

Please do not tell me this was the Fed's intention when they started all this ZIRP/QE madness way back when? I guarantee you it was not.

They just - as usual - horribly miscalculated.

Consumer confidence has been running above the baseline normal for some time:

https://research.stlouisfed.org/fred2/series/CSCICP03USM665S

Real personal consumption expenditures have also increased at an annualized rate of 3% or higher in 6 of the last 8 quarters:

http://www.bea.gov/newsreleases/national/gdp/2015/pdf/gdp3q15_2nd.pdf

I cannot comment on those surveys until I see the actual questions. As you are probably aware, surveys can be skewed to force a certain outcome by changing the wording and sequence of the questions. And as for spending, it CANNOT be substantial if the M2 Money Velocity is at an ALL TIME LOW. People are generally not spending (except the rich) - they are charging.

The home ownership rate from the late 1990s into the early 2010s was elevated, in large part, on account of the massive real estate bubble that developed. The rate is descending back toward more typical norms. That's not necessarily a bad thing.

If you look at the chart I provided above, you will see that the home ownership rate has fallen below what it was in the 'late nineties'. It has fallen to where it was in the mid 80's. And considering the M2 money velocity is still falling fast (overall) there is little reason to suspect this trend will subside. Imo, this is not a good thing. Especially considering most Americans make the vast majority of their capital gains from their principle residences.

People are talking about wealth inequality. Well, that is a big (though not the only) reason.

Continued...