I agree with you completely there, with the realization that it is just not going to happen until our society evolves more than it has to this point.

While this is only $1 billiion a year, I agree that policies like this which was are not there to encourage a positive outcome should be eliminated. I wonder why this, or any suggestions to cuts spending was not included in the GOP counter offer to the President. Have you actually read the GOP proposal (4 page letter), and the complete lack of any specificity?

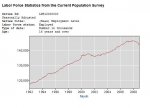

"Social Security isn't responsible for the federal deficit. Just the opposite. Until last year Social Security took in more payroll taxes than it paid out in benefits. It lent the surpluses to the rest of the government.

Now that Social Security has started to pay out more than it takes in, Social Security can simply collect what the rest of the government owes it. This will keep it fully solvent for the next 26 years. "

"oday, though, the Social Security payroll tax hits only about 84 percent of total income.

It went from 90 percent to 84 percent because a larger and larger portion of total income has gone to the top. In 1983, the richest 1 percent of Americans got 11.6 percent of total income. Today the top 1 percent takes in more than 20 percent.

If we want to go back to 90 percent, the ceiling on income subject to the Social Security tax would need to be raised to $180,000.

Presto. Social Security's long-term (beyond 26 years from now) problem would be solved."

Robert Reich: Budget Baloney: Why Social Security Isn't a Problem for 26 Years, and the Best Way to Fix It Permanently

Health care costs are the problem. Privatizing would only add to the cost for consumers.

"It is generally agreed that this industry adds 15 to 20 percent to the cost of its premiums to pay for its business overhead and profits, whereas the administrative costs of Medicare are less than 5 percent. "

Medicare and Private Health Insurance - NYTimes.com

As shown, SS has an easy fix to make it solvent for the long term. in order to most effectively deal with our health care cost we will eventually have to up grade to UHC as every other industrialized nation has had to do to lower health care costs.