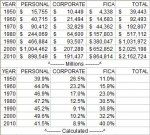

Thats pretty much it. This country doesn't have a revenue problem, the wealthy (both individuals and corporations) shoulder the lion share of federal contributions. We have a spending problem.

Frankly, I like the compromise floating around. Tax rates will return to the Clinton era as a long as spending does the same. Is that a "balanced approach?"

First off, corporations are playing a diminishing role in paying US income taxes. The notion that corporations pay the tax freight, while a romantic fantasy, is just wrong.

We should be lowering the tax rates but drastically eliminating loopholes, particularly cracking down on transfer pricing, which allows companies to off-shore profits through creative cost and revenue allocation schemes.

taxanalysts.com: Featured Articles -- International Tax Planning: A Guide for Journalists

But I am with you on returning to Clinton spending.... what a cool idea!

Let's see... in 2000, the last year of the balanced budget, on-budget expenditures (not including social security) were $1.48T. But, that was 12 years ago, and we are looking at the 2013 budget, so call it 13 years.... so, if we adjust that at the rate of 3% per annum to conservatively account for inflation and the growth in US population, then that Clinton number would be $2.15T. The actual expenditures for 2011 (not including SS) were $3.10T, so we are looking at cutting $1T of expenditure.

Historical Tables | The White House (see Table 1.1)

Let's see, if we start at the largest discretionary item.... that would be the military. We spent $354B on the military in 2000. Using our inflation formula above, well that would translate to $520B in 2013..... but wait, we actually spent $711B in 2011.... so we have quickly come up with $200B in cuts or solved 20% of the problem... with $800B to go.... wait, our tax cuts only changing the highest marginal rate is worth $80B... throw in a tax on interest and dividends over $100K and you have another $80B and suddenly we have solved 36% of the problem without too much sweat. Now that we are this far in, finding another $360B out of entitlement restructuring, though painful, is likely doable, and then your deficit is down to very manageable levels that can be cured by economic growth (and a more efficient corporate tax system that actually collects income taxes from corporations)...

Of course, if my growth estimate is actually too conservative and the number should be 4%, then target expenditures would be $2.425T and we would have to cut $600B out of the budget to balance it... and defense could only be cut by $100T of that, leaving $500B to figure out (of which our tax changes would solve a large part of the problem).

BTW... the current on-budget tax receipts estimate for 2013 (not including payroll taxes) is $2.3T...