- Joined

- Mar 27, 2012

- Messages

- 8,554

- Reaction score

- 1,924

- Location

- Oregon

- Gender

- Male

- Political Leaning

- Independent

It's a little early, but are you buying?arty

Yes. But you have to be smarter than a donkey, so sorry.

It's a little early, but are you buying?arty

You may be jumping up and down in sheer glee that we have a growing national debt which will be passed on to our children and future generations to pay. I imagine in some sick way, that is your right. Many of us are not happy about saddling our children and grand-children with massive debt and feel it is profoundly unfair to them.

And yet again I mention Luntz & Faris and that little rubber hammer swings and hits home producing the expected knee jerk response s you have to dig down and counter with Soros. That is sad.

And yet again, for a time beyond calculation, you pervert my position on tax increases. I am not advocating that YOUR taxes be raised. I am advocating that OUR taxes - as in ALL Americans who earn dollar one - be raised.

That is the responsible adult position for someone who believes we should hand our children a better nation that the one we were handed on the day we became Americans. Paying our bills is a major part of that.

I am talking about the tax on money or wealth that a person gets from another.

I thought that was sales tax.

you need to find new analogies. your fixation with rubber hammers and two pollsters is pretty well beyond rotted. Adults realize promising the children that they can have all they want while others are tasked to pay for it is idiotic. and that is the dem strategy.

you are being dishonest then. the tax is not based on what someone gets but what someone has at the time of their death

If a man has 10 million in wealth when he dies it matters not if he gives all ten million to one person, a million to ten people or ten dollars to a million, his wealth is still taxed the same

Care to try again?Exemptions and tax rates

Year Exclusion

Amount Max/Top

tax rate

2001 $675,000 55%

2002 $1 million 50%

2003 $1 million 49%

2004 $1.5 million 48%

2005 $1.5 million 47%

2006 $2 million 46%

2007 $2 million 45%

2008 $2 million 45%

2009 $3.5 million 45%

2010 Repealed

2011 $5 million 35%

2012 $5.12 million 35%

* under current law

As noted above, a certain amount of each estate is exempted from taxation by the federal government. Below is a table of the amount of exemption by year an estate would expect. Estates above these amounts would be subject to estate tax, but only for the amount above the exemption.

For example, assume an estate of $3.5 million in 2006. There are two beneficiaries who will each receive equal shares of the estate. The maximum allowable credit is $2 million for that year, so the taxable value is therefore $1.5 million. Since it is 2006, the tax rate on that $1.5 million is 46%, so the total taxes paid would be $690,000. Each beneficiary will receive $1,000,000 of untaxed inheritance and $405,000 from the taxable portion of their inheritance for a total of $1,405,000. This means the estate would have paid a taxable rate of 19.7%.

As shown, the 2001 tax act would have repealed the estate tax for one year (2010) and would then have readjusted it in 2011 to the year 2002 exemption level with a 2001 top rate. However, on December 17, 2010, Congress passed the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. Section 301 of the 2010 Act reinstates the federal estate tax. The new law sets the exemption at $5 million per person.[22] A top tax rate of 35 percent is provided for the years 2011 and 2012.[23]

you are being dishonest then. the tax is not based on what someone gets but what someone has at the time of their death

If a man has 10 million in wealth when he dies it matters not if he gives all ten million to one person, a million to ten people or ten dollars to a million, his wealth is still taxed the same

Might want to add that this tax for all intents and purposes starts before death. If someone were to give is children all of his money six months before he died the government will go back and assess the estate or death tax anyway. This is called a gift in contemplation of death.

So folks who say it is not a tax on an individual either are lying or don't know the law.

I know if I'm already deficit spending that I can decrease my spending and still be deficit spending. Are you so ignorant of accounting and simple arithmetic that you need examples to prove it? :roll:Yawn. Yes apparently I don't know the difference. There is no rational way you could have come to that conclusion based on what I wrote, but yes. Obviously.

Just as you obviously don't know how you get into debt. It is obviously not through spending right?

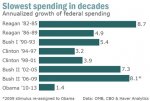

Of all the falsehoods told about President Barack Obama, the biggest whopper is the one about his reckless spending spree.

But it didn’t happen. Although there was a big stimulus bill under Obama, federal spending is rising at the slowest pace since Dwight Eisenhower brought the Korean War to an end in the 1950s.

Even hapless Herbert Hoover managed to increase spending more than Obama has.

This is simply done to prevent tax avoidance.

That's because they are not discussing facts; they are propagating propaganda. Unfortunately there are too many that are insufficiently astute to determine the difference.For some reason, few seem to be discussing the reality of Obama's spending, preferring the raw numbers without the context of population growth and costs inherited by the President.

For some reason, few seem to be discussing the reality of Obama's spending, preferring the raw numbers without the context of population growth and costs inherited by the President.

That is ONE way to look at it, here is another: U.S. Federal Deficits, Presidents, and Congress

Raising taxes on that percent of the population which has profited so greatly over the past 10 years is hardly "punishment"

This whole "punish the sucessful" meme is getting old. It's just another fine example of Luntz-style redefinition of reality for the learning-impaired.

Raising taxes on that percent of the population which has profited so greatly over the past 10 years is hardly "punishment"

This whole "punish the sucessful" meme is getting old. It's just another fine example of Luntz-style redefinition of reality for the learning-impaired.

Raising taxes on that percent of the population which has profited so greatly over the past 10 years is hardly "punishment"

asking the wealthiest Americans to have their tax rate increased by 3%, isn't "punishment".

they will still be able to buy their fancy cars, yachst, tanning beds, and Yankees box-seats.

infact, there is no evidence whatsoever that not extending their current tax-rates, would effect their spending one bit.

Finally Someone trying to do something for the class that carries this country, in WARS and economically by doing the LABOR and actual WORK...that produces our economy.

Its refreshing to have someone care about those that really need a break and not just slobbering all over themselves sniveling about how very bad the 1% that has 99% has it....

You mean this ...You know, it occurs to me. Are you aware as you write this that Romney has called for even greater tax breaks for the middle class than Obama has? Or are you just copy/pasting whatever rant your union sent you?

Romney-Style Plan Means Sharp Tax-Break Cuts, Study Says - BloombergThe Obama campaign has criticized Romney for not saying how he would offset the cost of the tax rate cuts.

“He refuses to say how he’d pay for that massive tax cut for the wealthy, which means he’s either exploding the deficit or, according to independent analysts, raising taxes on the middle class by closing tax breaks for mortgages, health care, retirement and other benefits the middle class rely on,” Ben LaBolt, an Obama campaign spokesman, said in a statement July 9.