The Prof

DP Veteran

- Joined

- Jul 26, 2009

- Messages

- 12,828

- Reaction score

- 1,808

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

1. Obama's bloated balloon is about to burst.

2. Or so argues the Grey Lady, New York Times.

3. Our trillion dollar deficit, cautions she, is currently being carried "on terms that seem too good to be true."

4. Spurious short-term loans secured at artificially low interest rates are due in mere months.

5. 36% of the government's marketable debt is times-up in the next 100 or so days.

6. The through-the-floor prime rate is similarly unsustainable.

7. When interest rates inevitably climb, the margin maintained on our national mortgage must augment measurably.

8. The methodologies employed by our administrators are compared by The Times to subprime.

9. ACCORDING TO THE WHITE HOUSE, service on the debt will be 700B by 2019.

10. The Times, however, surmises a sum far more immense.

11. "There is little doubt that the United States' long-term budget crisis is becoming too big to postpone," laments the Lady.

12. And beneath all THAT bad news is the bothersome incontrovertability of the budget-busting burden balanced upon our books by the imminent retirement of the baby boomers.

13. Such ominous awarenesses surely animated the admonishments whispered by Chairman Hu into Obama's oversized by uncomprehending ears in China.

14. How long can the communists be expected to underwrite US securities?

15. Ask SNL.

16. Or Aesop's industrious ant and good-times grasshopper.

17. Already, international investors are transferring their funds into stocks and more promising national entities like Brazil and Hu.

18. Meanwhile, Japan, Germany, Britain and others are in worse weather than we, applying even more upward pressure on premiums.

19. A big part of the problem, complains the report, is our government's investing in itself (T-bills) and MORTGAGE BACKED securities.

20. Home foreclosures, meanwhile, are through the roof, with no floor in sight.

21. Clever debt management cannot substitute for prudent fiscal policy, concludes the Lady.

22. She no longer gives the president a pass.

23. The media are turning on their man.

24. He, meanwhile, has been saying for a year, we must finish health care so we can start to address the economy.

Wave of Debt Payments Facing US Government - General * US * News * Story - CNBC.com

The Prof

2. Or so argues the Grey Lady, New York Times.

3. Our trillion dollar deficit, cautions she, is currently being carried "on terms that seem too good to be true."

4. Spurious short-term loans secured at artificially low interest rates are due in mere months.

5. 36% of the government's marketable debt is times-up in the next 100 or so days.

6. The through-the-floor prime rate is similarly unsustainable.

7. When interest rates inevitably climb, the margin maintained on our national mortgage must augment measurably.

8. The methodologies employed by our administrators are compared by The Times to subprime.

9. ACCORDING TO THE WHITE HOUSE, service on the debt will be 700B by 2019.

10. The Times, however, surmises a sum far more immense.

11. "There is little doubt that the United States' long-term budget crisis is becoming too big to postpone," laments the Lady.

12. And beneath all THAT bad news is the bothersome incontrovertability of the budget-busting burden balanced upon our books by the imminent retirement of the baby boomers.

13. Such ominous awarenesses surely animated the admonishments whispered by Chairman Hu into Obama's oversized by uncomprehending ears in China.

14. How long can the communists be expected to underwrite US securities?

15. Ask SNL.

16. Or Aesop's industrious ant and good-times grasshopper.

17. Already, international investors are transferring their funds into stocks and more promising national entities like Brazil and Hu.

18. Meanwhile, Japan, Germany, Britain and others are in worse weather than we, applying even more upward pressure on premiums.

19. A big part of the problem, complains the report, is our government's investing in itself (T-bills) and MORTGAGE BACKED securities.

20. Home foreclosures, meanwhile, are through the roof, with no floor in sight.

21. Clever debt management cannot substitute for prudent fiscal policy, concludes the Lady.

22. She no longer gives the president a pass.

23. The media are turning on their man.

24. He, meanwhile, has been saying for a year, we must finish health care so we can start to address the economy.

The United States government is financing its more than trillion-dollar-a-year borrowing with i.o.u.’s on terms that seem too good to be true.

But that happy situation, aided by ultralow interest rates, may not last much longer.

Treasury officials now face a trifecta of headaches: a mountain of new debt, a balloon of short-term borrowings that come due in the months ahead, and interest rates that are sure to climb back to normal as soon as the Federal Reserve decides that the emergency has passed.

Even as Treasury officials are racing to lock in today’s low rates by exchanging short-term borrowings for long-term bonds, the government faces a payment shock similar to those that sent legions of overstretched homeowners into default on their mortgages.

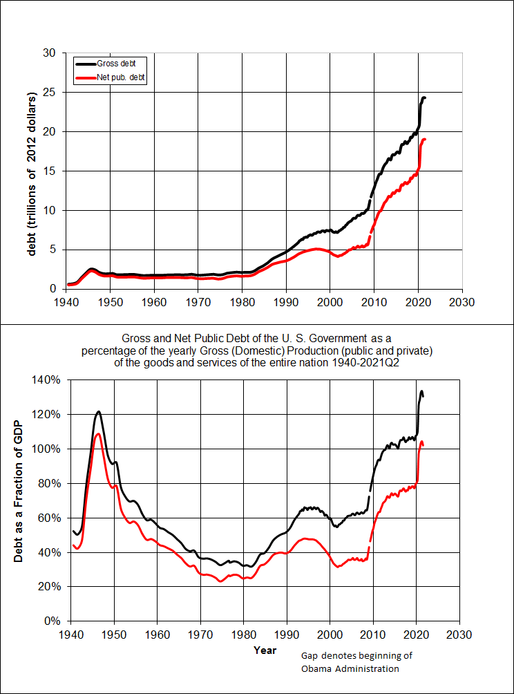

With the national debt now topping $12 trillion, the White House estimates that the government’s tab for servicing the debt will exceed $700 billion a year in 2019, up from $202 billion this year, even if annual budget deficits shrink drastically. Other forecasters say the figure could be much higher.

In concrete terms, an additional $500 billion a year in interest expense would total more than the combined federal budgets this year for education, energy, homeland security and the wars in Iraq and Afghanistan.

The potential for rapidly escalating interest payouts is just one of the wrenching challenges facing the United States after decades of living beyond its means.

The surge in borrowing over the last year or two is widely judged to have been a necessary response to the financial crisis and the deep recession, and there is still a raging debate over how aggressively to bring down deficits over the next few years. But there is little doubt that the United States’ long-term budget crisis is becoming too big to postpone.

Americans now have to climb out of two deep holes: as debt-loaded consumers, whose personal wealth sank along with housing and stock prices; and as taxpayers, whose government debt has almost doubled in the last two years alone, just as costs tied to benefits for retiring baby boomers are set to explode.

So far, the demand for Treasury securities from investors and other governments around the world has remained strong enough to hold down the interest rates that the United States must offer to sell them. Indeed, the government paid less interest on its debt this year than in 2008, even though it added almost $2 trillion in debt.

The government’s average interest rate on new borrowing last year fell below 1 percent. For short-term i.o.u.’s like one-month Treasury bills, its average rate was only sixteen-hundredths of a percent.

The problem, many analysts say, is that record government deficits have arrived just as the long-feared explosion begins in spending on benefits under Medicare and Social Security. The nation’s oldest baby boomers are approaching 65, setting off what experts have warned for years will be a fiscal nightmare for the government.

The current low rates on the country’s debt were caused by temporary factors that are already beginning to fade. One factor was the economic crisis itself, which caused panicked investors around the world to plow their money into the comparative safety of Treasury bills and notes. Even though the United States was the epicenter of the global crisis, investors viewed Treasury securities as the least dangerous place to park their money.

On top of that, the Fed used almost every tool in its arsenal to push interest rates down even further. It cut the overnight federal funds rate, the rate at which banks lend reserves to one another, to almost zero. And to reduce longer-term rates, it bought more than $1.5 trillion worth of Treasury bonds and government-guaranteed securities linked to mortgages.

Those conditions are already beginning to change. Global investors are shifting money into riskier investments like stocks and corporate bonds, and they have been pouring money into fast-growing countries like Brazil and China.

The Fed, meanwhile, is already halting its efforts at tamping down long-term interest rates. Fed officials ended their $300 billion program to buy up Treasury bonds last month, and they have announced plans to stop buying mortgage-backed securities by the end of next March.

Eventually, though probably not until at least mid-2010, the Fed will also start raising its benchmark interest rate back to more historically normal levels.

The United States will not be the only government competing to refinance huge debt. Japan, Germany, Britain and other industrialized countries have even higher government debt loads, measured as a share of their gross domestic product, and they too borrowed heavily to combat the financial crisis and economic downturn. As the global economy recovers and businesses raise capital to finance their growth, all that new government debt is likely to put more upward pressure on interest rates.

Even a small increase in interest rates has a big impact. An increase of one percentage point in the Treasury’s average cost of borrowing would cost American taxpayers an extra $80 billion this year — about equal to the combined budgets of the Department of Energy and the Department of Education.

But that could seem like a relatively modest pinch. Alan Levenson, chief economist at T. Rowe Price, estimated that the Treasury’s tab for debt service this year would have been $221 billion higher if it had faced the same interest rates as it did last year.

The White House estimates that the government will have to borrow about $3.5 trillion more over the next three years. On top of that, the Treasury has to refinance, or roll over, a huge amount of short-term debt that was issued during the financial crisis. Treasury officials estimate that about 36 percent of the government’s marketable debt — about $1.6 trillion — is coming due in the months ahead.

To lock in low interest rates in the years ahead, Treasury officials are trying to replace one-month and three-month bills with 10-year and 30-year Treasury securities. That strategy will save taxpayers money in the long run. But it pushes up costs drastically in the short run, because interest rates are higher for long-term debt.

This story originally appeared in the The New York Times

Wave of Debt Payments Facing US Government - General * US * News * Story - CNBC.com

The Prof