So you are seriously suggesting - to ANY extent - that the American economy is doing better now then it has at any time in the last 40 years?

Better than some, not as well as others.

Real GDP has expanded at a 1.9% annual rate since 2010, after having grown at only 1.5% 2002-09.

>>That it is better now then during the booming eighties or during the dot.com boom or during the housing boom?

Those periods were indeed better by that measure — 3.5% 1994-2001 and 3.3% 1981-93. The economy expanded at a 2.1% annual rate 1977-81.

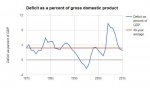

We "benefited" during the Reagan/Bush41 era from a lot of deficit spending, as the national debt as a percentage of GDP doubled, from 31% to 62%. Clinton had the Information Revolution as a strong wind at the economy's back.

>>[Initial unemployment claims] is an overrated statistic. It can mean that times are good or it can mean that practically everyone that will file an initial claim has filed or a combination thereof.

So consider it in light of other stats, like U-6 and U-3.

>>And forget using the U-3 - it is a joke. You could have only one person working in America and … [blah, blah, blah]. That is ridiculous.

I agree. This REALLY stupid story you have repeated over and over about "Gee, if only one person …" is as ridiculous a pile of nonsense as anyone could possibly imagine.

>>And even if the jobless numbers and the unemployment rate were accurate gauges of the economy...they mean little since the Fed is still running almost 0% rates …

More nonsense that you puke up over and over. Interest rates can be considered in this context only as they relate to inflation.

Both are very low.

>>The powers that be should only take a bow when the economy can stand on it's own without MASSIVE assistance from deficits and the Fed. And that has not occurred since Obama took office.

The deficit as a percentage of GDP has dropped under Obummer from 10% to 2.5%, which is surely

not "MASSIVE assistance." As always, yer claims are foolish/outrageous.

>>The U.S. economy AND the stock markets are stagnant

Yes, "stagnant" in the sense that the Dow is up 164% over the last seven years, while, as I noted, the economy is growing faster under Obummer than it was under the previous administration.

>>the middle class has been semi-gutted since 2007

It's suffered for forty years.

>>food stamp usage is up roughly 40% since the Great Recession started (and refuses to drop much)

14.7 million people were added to the food-stamp rolls during George W. Bush’s time in office. By comparison, the net gain under Obama now stands at just under 13.4 million — and it’s slowly declining as the economy improves. — "

Obama’s Numbers (January 2016 Update)," factcheck.org, Jan 12, 2016

>>home ownership rate is lower now then it was 40 years ago.

And it's about the same as it was in the, as you described them, "booming eighties."

>>I have ZERO political affiliation. I despise both major parties

Good for you.