- Joined

- Nov 16, 2014

- Messages

- 6,639

- Reaction score

- 1,487

- Location

- Pennsylvania, USA

- Gender

- Male

- Political Leaning

- Other

Entitlements are not THE problem. They are A problem, among many.

I would at least cut every single one of those, and eliminate several.

Good for you, but it misses the context of why it was presented.

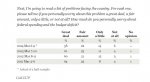

People (voters) repeatedly show they have no real commitment to cutting the deficit, as the chart reveals.