- Joined

- Mar 5, 2008

- Messages

- 112,969

- Reaction score

- 60,505

- Location

- Sarasota Fla

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Ah, so every one is a couple people saying marginally related things. Got it.

Ah, so every one is a couple people saying marginally related things. Got it.

I'll tell you what.... You live in that wonderful republican owned economy of 2008 then.

PS... I did not vote for Obama in 2008.

Let's see if I have this right, Bush with a Democrat Congress in 2007-2008 is responsible for the results but with Obama and a Democrat Congress from 2009-2011 and a split Congress from 2011 to the present isn't responsible for the economy and its Congress's fault? When exactly does the Economy become Obama's? Would love to have an answer but doubt I will get one

Well this is what we get when our conservative scotus tells us corporations are people and money is speech. The too big too fail "people" become the only speech our politicians can and want to hear.

Like GM, you mean? The UAW was too big to fail, but you don't seem to mention that.

Not true, Reagan inherited double digit interest rates, poverty rates were at a all time high, and Unemployment rates were higher and you're STILL 6 years in blaming Bush.

Its getting childish.

the terrible April departure of people from the labor force

Everything I read says people are giving up looking for work in droves.

the worst growth rate after a recession in modern times.

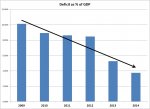

Do you realize that the total debt now exceeds 100% of GDP

Uhm, what persistent growth ? GDP would indicate "persistent growth".

Was this 5 year period a typical recovery?

Tell me how the 3.9 trillion dollar Obama budget shows someone interested in lowering the deficit and debt?

Whether you can call this job growth is an open question. The raw numbers are higher, but the working-age population has also grown.

Reagan was actually qualified

Reagan inherited double digit interest rates

After the 81-82 Carter double dip, Reagan had 7.5% GDP growth. That shows what leadership can and will do.

QE is artificially boosting asset prices and lowering risk. thought this was common knowledge.

It [labor force participation] has clearly and indisputably declined more severely since 2008-2009.

that massive stimulus that Reagan implemented created 17 million jobs

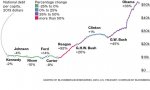

And nearly doubled the per capita national debt.

View attachment 67167359

>>doubled the GDP

Real GDP:

1980 — 6.49 trillion

1988 — 8.60 trillion

A 32.5% increase.

>>increased FIT revenue by 60%.

A big increase in Social Security taxes played a large role in generating that additional revenue.

In 1983, for example, he signed off on Social Security reform legislation that, among other things, accelerated an increase in the payroll tax rate, required that higher-income beneficiaries pay income tax on part of their benefits, and required the self-employed to pay the full payroll tax rate, rather than just the portion normally paid by employees. — Taxes: What people forget about Reagan," CNNMoney, Sept 12, 2010

>>It also created a peace dividend that was wasted

Yeah, wasted when Chaingang and associates ignored the clear warnings of an imminent Al Qaeda attack inside the US, and then spun their lies to get us to invade Iraq.

>>facts never were much of a friend to you

I always get a laugh out of yer arrogant ignorance.

>>someone who probably hadn't been born yet

http://www.debatepolitics.com/break...te-holds-steady-6-7-a-110.html#post1063275988

>>you buy what the left tells you. one of these days you will outgrow that

Sadly, it looks like you'll never outgrow yer … disorder.

By the way, "real" GDP?

Real GDP means GDP in constant dollars or after-inflation GDP. Nominal GDP means GDP in current dollars or unadjusted for inflation.

Economists focus on real GDP (and the 1% annualized contraction for Q1 concerns real GDP), because that measure deals strictly with economic growth. Nominal GDP includes inflation. Hence, the economy might experience no growth whatsoever, but inflation would lead to a higher nominal GDP figure creating the perception of economic growth when none actually occurred.

Great, the problem is Govt revenue, debt, and components of GDP at the time aren't generated in inflation adjusted dollars. Reagan had a GDP growth that doubled in nominal dollars and the revenue generated was in nominal dollars.

They don't. They dislike inflation, but many also want low interest rates. Go figure.Double digit interest rates? lol. I thought conservatives loved high interested rates.

I was providing a technical point regarding the "real GDP" term. One can get data concerning revenue and expenditures in constant and current dollars and as a percent of GDP at: http://www.whitehouse.gov/sites/default/files/omb/budget/fy2015/assets/hist01z3.xls

My personal opinion is that President Reagan was a superb leader. While he came to Washington expecting to cut the nation's deficits, seek to revive its economy, and bolster its military capabilities (to press the USSR), he quickly realized that he could not accomplish all three simultaneously. Deficits would be increased by cutting taxes (which would shift the supply curve to the right and complement the Fed's battle on inflation) and by raising military expenditures. He prioritized and chose economic revival and increased defense expenditures at the expense of deficit reduction. He also made tax-related concessions in helping extend the solvency of Social Security. He was a leader who saw the big picture, understood the need to work with Republicans and Democrats, and knew how to bring people together toward common goals (even as they disagreed on many issues). He was also willing to revise his approaches e.g., the Social Security plan had a revenue component to it. His shift from confrontation to engagement with the Soviet Union was a pivotal shift and he made it in the face of stiff opposition among many of his senior officials.

You and I are in agreement about Reagan's leadership skills and ability to get things done through Congress. We disagree however that cutting taxes caused the deficits as no one can prove that we would have generated 17 million new jobs and thus new taxpayers without the tax cuts. Human behavior is a foreign concept for far too many just like their lack of knowledge as to the components of GDP.

Clearly, there are behavioral (second and third-order impacts) from tax policy changes. Those effects are highly complex and there is a lot of uncertainty. Hence, they are not well-modeled.

For that reason, the Congressional Budget Office (CBO) uses a static baseline. According to that baseline, tax revenue was lower than it would otherwise have been.

At the same time, there are hints that there had, in fact, been some behavior effect. First, tax revenue proved higher than had otherwise been projected. Second, if one used a “quick and dirty approach” and estimated tax revenue based on GDP trend growth (the Reagan period saw above trend growth) and the average tax revenue as a share of GDP, there was a gap. However, the faster growth or growth premium helped mitigate the gap that would have existed had GDP expanded at trend rate. Some economists suggest that a persistent growth premium (over the trend line) would, over a period of time, lead to tax revenue being at least as high as it would have otherwise been absent tax rate reductions.

In any case, those are highly technical and much debated matters. There is some behavioral impact, but it can’t be estimated precisely.

In the end, Reagan was satisfied that he had gotten most of what he set out to achieve in Washington. He had reduced tax rates, including the highest marginal rate. He had presided during a robust economic revival. He was able to strengthen the nation’s defenses and believed that had played a role in making possible renewed engagement with the Soviet Union. He was disappointed that he could not contain growth in other spending.

...

Was this a business cycle recession?

U.S. GDP Contracted at 1% Pace in First Quarter - WSJ.com

"he U.S. economy contracted in the first quarter of 2014, the latest stumble for a recovery that has struggled to find its footing since the recession ended almost five years ago."

The "recovery" is over.