I lived through it. I was a junior in college when Mr. Carter was elected. I don't remember things the same way.

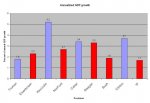

Real (inflation-adjusted) GDP grew at 4.6%, 5.6%, 3.2%, and -0.2%. That last year, 1980, certainly was not a good one. We had been hit by the second oil shock in '79, and the Fed put interest rates through the roof.

There was indeed a recovery in 1981, but real GDP went up only 2.6%. Then we had a very bad year in 1982, down by 1.9%. The next six years were 4.6%, 7.3%, 4.2%, 3,5%, 3.5%, and 4.2%.

During that time, per capita national debt increased by 92%. That's quite a stimulus.

View attachment 67166470

The underlying trend can be seen by looking at a ten-year moving average:

View attachment 67166471

Things were more or less steady although somewhat restrained under Carter, and at first declined sharply and then recovered rapidly under Reagan. You can compare the overall numbers in this chart of annualized GDP growth:

View attachment 67166472

I would argue that the very strong year (1984) was a recovery from a business cycle recession, while the economy Obama inherited had suffered a near-collapse of the financial sector more akin to the Great Depression. The dynamics and psychology are different. Even if things are handled properly, a few years are typically required to unwind, deleverage, and settle people's fears. I'm hoping we're in a good position now and that 2014 and beyond will see substantial growth. There's no doubt that public optimism will be required.

>>See, this is the Liberal battle cry..."Nothing we can do about it".... I don't buy that, it's defeatist, and IMHO, Not what most American's think.

You mistook my meaning. I was responding to "Sorry, something stinks in the data." I was being a wise-ass. Happens about once every few minutes. Fwiw, I don't agree that the "data stinks."

>>Simply not true...The labor force participation rate is the lowest in history, and hasn't seen these type of numbers since 1978...

LFP has indeed been declining since the turn of the century for a variety of reasons, mostly demographic. (The best way to solve that is through immigration reform.) But the numbers aren't all that significant.

Here's the question i would ask you: Between 1948 and 1968, LFP never went above 60%. Since then, it's gone up to around 66% and now back down to around 63% as baby boomers have begun to retire and fewer women are working. Between '48 and '68, GDP quadrupled. It went up in every year except 1949. I'd say we could use a strong, stable expansion like that. Will we get it? Difficult t' say.

If we don't, I don't think it'll be because LFP is 63% instead of 66%. Other factors, like our educational and infrastructure base, and, yes, our fiscal discipline will be more decisive. That does not, imo, mean that we need to shrink the government. It means we need to improve the effectiveness and efficiency of both the private and public sectors. One way to get a lot of that done is to have them work more effectively together. I say we need to "own" the government, not rail against it. We

are the government. That is the powerful legacy and heavy responsibility we've both earned and inherited.

>>Obama has had 6 years so far to turn this around, with similar situations upon entering office it only took Reagan 3 years

Ii think yer overstating Mr. Reagan's achievements and understating Mr. Obama's challenges.