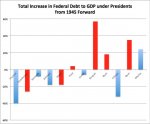

Much better. I am glad to see you are willing to confront the point. Though, obviously you have given up on denying the fact that debt to GDP consistently rises during the Republican administrations and falls during the Democratic administrations....

View attachment 67149973

.... and settled for the "deny the quality of the fact" (the "so-what?" retort).

Sorry, the aggregate value of the debt means nothing unless compared to something... some benchmark. Almost all bankers will tell you that total debt means nothing unless compared to ability to pay. General Electric has almost 1/2 trillion of debt. Is that more troublesome than an unemployed middle manager with a $100,000 mortgage? Though the GE debt is 5Billion times that of the middle manager, which banker do you think loses more sleep?

Aggregate debt has no significance without a comparison to debt service capacity. What is the source of the debt service capacity of the United States? The ability to tax. What does the government tax? Economic activity a/k/a GDP. The higher the GDP, the higher the tax receipts. US government debt service is derived from GDP (private sector activity).... on the flip side, government expenditures, though less correlated, are also a function of GDP. The fact the US taxes are amongst the lowest in the world and it has one of the largest GDPs lets us realize that there is a lot more debt service capacity that can be tapped into, if required.

Now I appreciate the fact the Republicans have a remarkably poor record in managing the debt when they hold the executive office (see chart above), but you will just have to accept their P-poor performance here if you want to complain about the debt (accept the fact that your party is a big part of the problem, then you have the credibility to complain about the problem (AA 101))

There has been an interesting line of reasoning that the Cons deliberately run up the debt while in power and then turn around and complain about it when out of power, forcing the Dems to do the nasty work. That is an interesting allegation and completely consistent with the chart above.

So, if you want to tell us debt to GDP is meaningless, then help us with a generally accepted measure of debt service capacity to help us understand why the debt now is a bigger problem then it was in 1945, 1965 or 1985. I doubt you will have a metric better than debt to GDP.

.... I stand ready to put on my obfuscation mask...