- Joined

- Apr 11, 2011

- Messages

- 13,350

- Reaction score

- 6,591

- Gender

- Male

- Political Leaning

- Independent

Total nonsense. A flat tax is clearly regressive.

Explain how it would be total nonsense.

Total nonsense. A flat tax is clearly regressive.

Totally false, a lowering of taxes on the top with an increase on low wage earners will increase the wealth gap.Creating a flat tax does not cause any wealth inequality. If anything it does the exact opposite.

So does that change in any way your previous belief about the tax ideas of today's Dem and Kennedy Dems?

It is your claim that it would not, you back yours.Explain how it would be total nonsense.

Obviously, he would not join the GOP now. They were good with 70% top marginal rate then. Now you guys are talking about 15%.

Totally false, a lowering of taxes on the top with an increase on low wage earners will increase the wealth gap.

You have nothing to base your claim on.

Oh, you have once again a failure of your memory and a context failure.Don't think I posted anything other than - "The Libby/Demos of today are not Kennedy Democrats". So I don't know where you have me talking about "tax ideas of today's Dem and Kennedy Dems".

You must have been reading someone else's posts.

It is your claim that it would not, you back yours.

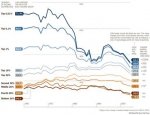

Ever since the decline in top marginal rates in the US after WWII, we have seen a steady rise in wealth inequality.

http://www.nytimes.com/2012/04/17/b...piketty-the-buffett-rule-is-just-a-start.html

This has nothing to with what I am saying

looks like you were arguing for 15%:Very few people in this country actually pay 30% in taxes on their total income. What I want to see happen would have almost everyone paying more. You, and some others, think a flat tax would be lowering it for the wealthy. That is completely insane. Aside from people who pay nothing in taxes, the wealthy pay the lowest rates on their total income. Many of them dont even pay 30% on their adjusted income.

So charge everyone a flat rate. 15% gets you about 1.3 trillion straight up revenue.Thats what I have been saying for years and multiple times in this thread.

This has nothing to with what I am saying

Of course it does. As the tax rate for the rich began to fall, the wealth gap increased.

muc said:the wealthy pay the lowest rates on their total income. Many of them dont even pay 30% on their adjusted income.

It has EVERTHING to do with having a healthy economy which you don't seem to understand is THE most important thing.

looks like you were arguing for 15%:

Regardless of what flat rate you want to charge EVERYONE, a flat tax INCREASES the WEALTH INEQUALITY in a state. I just got done showing you that with the minor progressive levels we have now has caused GREATER wealth inequality than what we experienced when the top marginal rates were higher.

You still won't show any evidence that a flat tax reduces wealth inequality.

You don't understand that wealth inequality creates an unhealthy society.A key to a healthy economy is generating money via taxes. How is this that hard to understand?

Then go to the source. I now know that you did not read the NYT article I linked to.I cant read that.

A flat national sales tax would tax 80 to 100% of middle class income because they spend 80 to 100% of what they make.

it is the opposite of what we need to have a healthy economy. Without a healthy growing economy revenues will decrease and the debt will increase no matter what we do.

Repeat....Clearly you are not reading my posts. Go back and read buddy. I have been saying 30% across the board repeatedly.

Regardless of what flat rate you want to charge EVERYONE, a flat tax INCREASES the WEALTH INEQUALITY in a state. I just got done showing you that with the minor progressive levels we have now has caused GREATER wealth inequality than what we experienced when the top marginal rates were higher.

You don't understand that wealth inequality creates an unhealthy society.

Repeat....

I have many times already said to you that even with the progressive system we have now, we are experiencing GREATER wealth inequality, it is worse that when the progressiveness was GREATER. Your argument is that a flat tax would be better at counteracting wealth inequality even though it flies in the face of our own experience and the experience of the rest of the world. I gave you a NYT article addressing this very point...and you won't read it.You are failing to explain how a flat tax would create any type of wealth inequality. Until you can do that, your are arguing something that isnt being said. If anything a flat tax would bridge that gap.

lol....you won't read anything i link to.you saying it doesnt make it true. You have shown nothing.