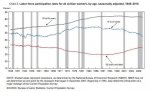

First, and most commonly observed, the unemployment rate is not only capturing

changes in employment, but it is also measuring changes in labor force

participation ( Chart 1). The labor force participation rate measures the percent of

the working-age population that is either working or searching for employment.

There are two factors which determine the labor force participation rate:

demographics (such as baby boomers entering the early retirement years) and

the health of the economy (per ceptions of whether it is possible to find a job).

Since the recession began in December 2007, the labor force participation rate

has declined over 2.0pp to 63.9%, of which 1.2pp was due to population shifts

into age groups that tend to work less ( Table 1). Since we cannot fight the aging

process, the downward pressure from the aging population will continue.

But, we should expect at least part of the cyclical drop in the participation rate to

reverse as the labor market heals. If t he current pace of job creation persists and

people start to perceive that there are greater job opportunities, discouraged

workers will return to the labor force. This includes many young adults who went

back to school rather than face a very tough job market. This means that as job

growth picks up, so will the participation ra te. That in turn means the drop in the

unemployment rate will slow even when job growth accelerates.

Second, not all unemployment is the same . Most of the gain in unemployment

comes from record high “long-term” unemployment. As Chart 2 shows, there are

a record number of people who are unemployed for greater than six months. In

contrast, the short-term unemployment rate has fallen sharply and returned to

normal levels. This suggests labor misallocation – those with certain skill sets can

find employment in short order while others can struggle with unemployment for

some time.

Finally, the unemployment rate does not capture the quality of jobs. For example,

it does not distinguish between full-time and part-time jobs. During the recession

there was a big increase in part-time workers, which has remained high. These

workers are counted as “employed” even though in reality they are half

unemployed. In addition, it does not provide information about the quality of jobs

in regards to compensation or skill se t. This all matters because the standard

inflation models use the unemployment ra te as a way to determine the amount of

slack in the economy, and hence wage pressu re. It is therefore useful to control

for these other factors when using slack models for inflation.

Bottom line: Don’t be surprised if the unemployment rate remains sticky even once job growth accelerates.

Second, there are often seasonal distortions. Poor weather conditions during the

survey week, such as a snow storm, will make it difficult for people to report to

work. If a non-salary worker does not receive compensation during the survey

week, it will count as a job loss. The BLS attempts to control for normal seasonal

swings, but sometimes that creates distortions by over-adjusting the data. This

may be playing a role in the recent data given the abnormally mild winter. As

Chart 3 shows, there were considerably fewer reports of people not reporting to

work as a result of the weather this winter. The average from December through

February this year was 170,000 workers compared to the historical average of

290,000 and clearly well below the last two years.

Simply looking at total job growth gives us a sense of how much more income is

being generated in the economy. However, it does not tell us how much more we

should be creating. The US population is steadily expanding, which means we

need to see a constant gain in jobs to simply keep up with the expanding labor

force. With population growth of nearly 1% a year, we need to see job gains of

about 110,000 a month just to meet the expanding population. This is considered

the “breakeven” level for the unemployme nt rate. However, as discussed above,

the unemployment rate is also affected by changes in the participation rate. In this

cycle, the sharp drop in t he participation rate prevented a bigger rise in the

unemployment rate.

As such, a better way to look at the health of the job market is to look at the ratio

of employment to population (Chart 4). Since the recession officially ended in

mid-2009, the employment -to-population ratio has been moving sideways. The

past few payroll reports helped to push it up only very marginally. This means that

household income will remain constrained and budgets will be tight.

Bottom line: job growth is still insufficient given expanding population. This will

keep household budgets and tax revenues constrained.

Bottom line: job growth is still insufficient given expanding population. This will keep household budgets and tax revenues constrained.

Taking all the favorite measures of the labor market into consideration, there are

clear indications of healing. However, we will be watching the post-winter data

very closely to see if the improvement is sustainable.