- Joined

- Sep 29, 2007

- Messages

- 29,262

- Reaction score

- 10,126

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Planet Money has obtained a secret government report outlining what once looked like a potential crisis: The possibility that the U.S. government might pay off its entire debt.

It sounds ridiculous today. But not so long ago, the prospect of a debt-free U.S. was seen as a real possibility with the potential to upset the global financial system.

We recently obtained the report through a Freedom of Information Act Request. You can read the whole thing here. (It's a PDF.)

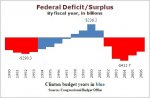

The report is called "Life After Debt". It was written in the year 2000, when the U.S. was running a budget surplus, taking in more than it was spending every year. Economists were projecting that the entire national debt could be paid off by 2012.

Source: CBO and OMB (Debt held by the public)

Credit: Alyson Hurt and Jess Jiang / NPR

This was seen in many ways as good thing. But it also posed risks. If the U.S. paid off its debt there would be no more U.S. Treasury bonds in the world.

"It was a huge issue.. for not just the U.S. economy, but the global economy," says Diane Lim Rogers, an economist in the Clinton administration.

The U.S. borrows money by selling bonds. So the end of debt would mean the end of Treasury bonds.

But the U.S. has been issuing bonds for so long, and the bonds are seen as so safe, that much of the world has come to depend on them. The U.S. Treasury bond is a pillar of the global economy.

What If We Paid Off The Debt? The Secret Government Report : Planet Money : NPR

It sounds ridiculous today. But not so long ago, the prospect of a debt-free U.S. was seen as a real possibility with the potential to upset the global financial system.

We recently obtained the report through a Freedom of Information Act Request. You can read the whole thing here. (It's a PDF.)

The report is called "Life After Debt". It was written in the year 2000, when the U.S. was running a budget surplus, taking in more than it was spending every year. Economists were projecting that the entire national debt could be paid off by 2012.

Source: CBO and OMB (Debt held by the public)

Credit: Alyson Hurt and Jess Jiang / NPR

This was seen in many ways as good thing. But it also posed risks. If the U.S. paid off its debt there would be no more U.S. Treasury bonds in the world.

"It was a huge issue.. for not just the U.S. economy, but the global economy," says Diane Lim Rogers, an economist in the Clinton administration.

The U.S. borrows money by selling bonds. So the end of debt would mean the end of Treasury bonds.

But the U.S. has been issuing bonds for so long, and the bonds are seen as so safe, that much of the world has come to depend on them. The U.S. Treasury bond is a pillar of the global economy.

What If We Paid Off The Debt? The Secret Government Report : Planet Money : NPR

If you feel some one is trolling, use the report post button, don't accuse them inthread.

If you feel some one is trolling, use the report post button, don't accuse them inthread.