So are United and American still serving Fantasyland. Are the flights direct, or do they still require a change in Chicago?

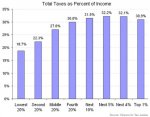

First, no one pays ZERO taxes. Different people pay different types of taxes in different portions. Funny, but all in, it seems we actually have a bit of a flat tax with almost everyone paying between 20 and 30% of their income in taxes.

View attachment 67132409

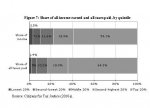

For example, the poor pay a much, much higher percentage of their income on FICA and sales taxes than anyone else. They don't pay much in the way of income tax, because the income tax system is designed to tax discretionary income (rather than total income, with discretionary income being income after certain essentials are paid for, like room and board) and the poor, by definition, have no discretionary income so they pay no income tax. The middle class, being the higher earning labor force, pay a higher percentage of their income on income tax and property tax. The rich, though they pay the most in aggregate taxes actually pay FICA, sales taxes at a much lower rate than the poor and middle class and property taxes and income taxes at a generally lower rate than the middle class. In general, they pay more in aggregate income taxes than others largely because they have the lion's share of discretionary income in the US. OTH, the total tax burden is surprisingly well distributed

View attachment 67132406

Now this whole idea of loopholes is deliberately vague. A loophole in its purest form is using the tax code to your advantage in a way that it was not intended. For example, there are many wealthy people here in Colorado with large land holdings that stick a few cattle on their property to establish themselves as a ranch for the purpose of paying lower property taxes. That is a loophole, as they are not really a ranch, just technically one. On the other hand, many people want to think of anything you deduct as a loophole. That is absurd,as income taxes are about income... and any business must deduct expenses from revenue to calculate income. Its just accounting 101.

Now, individual returns have Schedule A deductions. These are things like home mortgage interest, deduction state income taxes from your federal tax calculation, high medical expenses, job hunting expenses., etc. Are these loopholes? I don't think so. These are things that congress passed to incent home ownership and give the middle class some relief. We also have exemptions for dependents... again, used as a simple means of calculating the room/board, non-discretionary portion of income. You want to eliminate home mortgage interest? Be my guest, but watch the housing market lose 25% of its value immediately (BTW, did you know that is the largest single element of wealth of most of the middle class?). Frankly, I don't think you will find too many loopholes in individual income taxes... though I might suggest the concept of carried interest or capital gains recognition of trading stocks probably apply... but given carried interest is how Romney and his buddies pay only 15% tax, good luck getting that by.

Again this whole idea of loophole plays well to those that have no idea how taxes actually work (like 95% of the electorate), but they are no where near as obvious as the vague term 'loophole" makes it sound. That is probably why Ryan can't actually name a loophole he would close.

Ryan Promises To Close Tax Loopholes, But Won’t Say Which | TPMDC

Let's assume for a wild minute (we can all have our fantasies) that Ryan is actually talking about corporations (which he isn't:

Paul Ryan Says He Wouldn't Close Corporate Tax Loopholes To Prevent Student Loan Interest Hike | ThinkProgress). They do have some pretty interesting loopholes, like massive credit carry forwards and carrybacks, accelerated depreciation and expensing of capital equipment, and my favorite, that ability to assign costs and revenues to different countries allowing them to show all of their profit outside the US, so they never pay US tax, even though most profit is actually within the US. The problem with corporations is that they can actually fight back. Actually, fight back is putting it the wrong way: they get to dictate how stuff is done via lobbyists and campaign fund direction (essentially bribes). Don't look for any loopholes to be closed here.

Sorry, but until you starting hearing real specifics. this guy [Ryan] has no more love for you nor is he any more sincere than the average lounge lizard at midnight on a Saturday.